- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

What You Need To Know Ahead of International Paper's Earnings Release

/International%20Paper%20Co_%20sign%20by-%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Valued at a market cap of $24.1 billion, International Paper Company (IP) is a global producer of renewable fiber-based packaging and pulp products. Operating through its Industrial Packaging and Global Cellulose Fibers segments, the company serves customers across North America, Latin America, Europe, and North Africa.

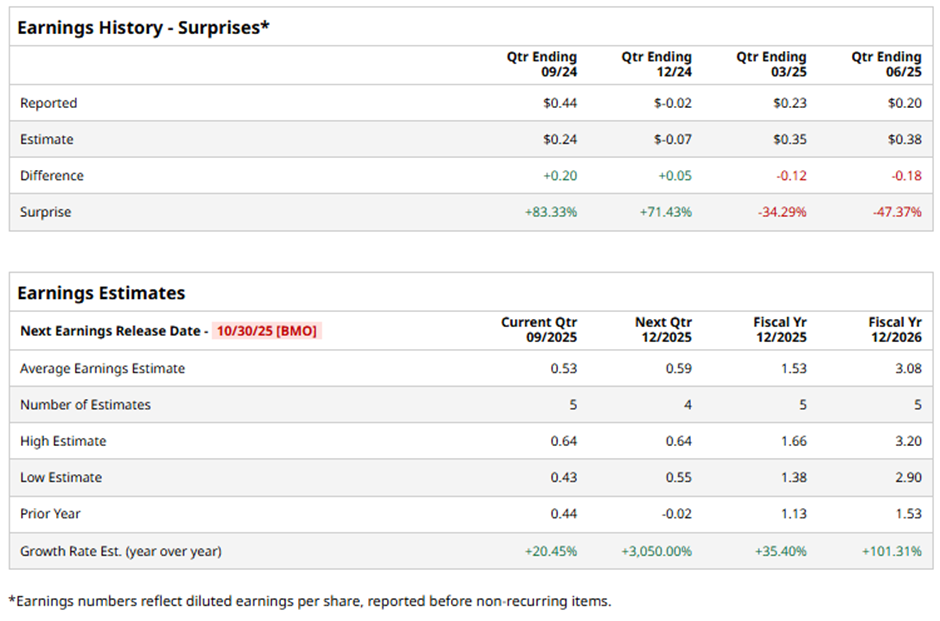

The Memphis, Tennessee-based company is expected to release its fiscal Q3 2025 results before the market opens on Thursday, Oct. 30. Ahead of this event, analysts project International Paper to report an adjusted EPS of $0.53, a 20.5% increase from $0.44 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in two of the last four quarterly reports while missing on two other occasions.

For fiscal 2025, analysts forecast the global paper and packaging company to report adjusted EPS of $1.53, up 35.4% from $1.13 in fiscal 2024. In addition, adjusted EPS is expected to surge 101.3% year-over-year to $3.08 in fiscal 2026.

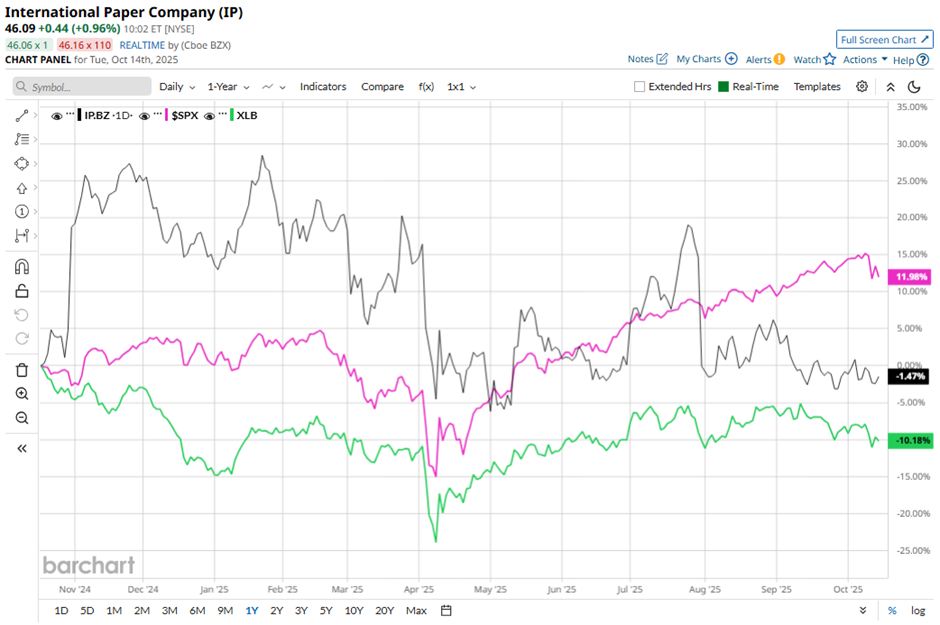

Shares of International Paper have fallen 5.2% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 12.2% gain. However, the decline is less severe than the Materials Select Sector SPDR Fund's (XLB) 9.1% drop over the same time frame.

Shares of International Paper tumbled 12.9% on July 31 after the company reported disappointing Q2 2025 results, with adjusted EPS of $0.20, far below analyst expectations. The shortfall was driven by steeper input costs for corrugated cardboard and fiber packaging products, along with muted demand in Europe.

Analysts' consensus view on IP stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 13 analysts covering the stock, six suggest a "Strong Buy," one gives a "Moderate Buy," four recommend a "Hold," and two "Strong Sells." The average analyst price target for International Paper is $54.11, indicating a potential upside of 17.4% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.